But if you had reinvested them, it would be worth a massive £1.63 million. For savers, it means earning interest on your original principal—plus on the interest your investment generates. Compound interest is sometimes described as “interest on interest” because earned interest essentially gets added to the principal over time.

- We’d be remiss to talk about future projections without mentioning inflation.

- We suspect that this perspective on the power of compound interest is a fairly modern invention, one which has been retroactively placed into the mouth of a prominent dead person to give it more punch.

- Simply divide 72 by the interest rate, and voila, you have the number of years it’ll take to double your money.

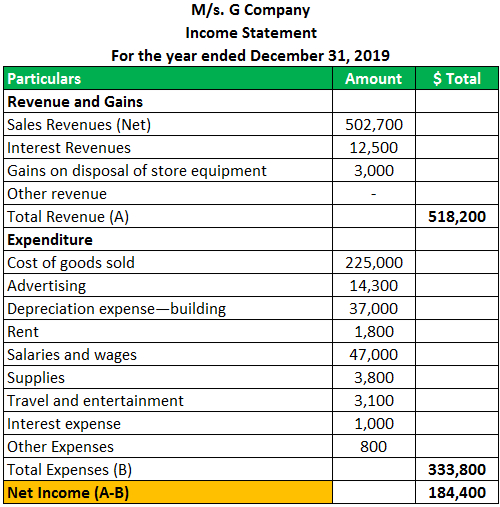

- To better understand the difference, view the table below comparing the advantages and disadvantages of compound and simple interest.

- The frequency could be yearly, half-yearly, quarterly, monthly, weekly, daily, continuously, or not at all until maturity.

Contents

How Does Compound Interest Depend on Time Period?

This is because simple interest is calculated only on the principal in every tenure, whereas compound interest is calculated on the principal amount + interest so far. Instead of writing R/100 every time, we usually convert the rate into decimals by dividing by 100 to get r and substitute it in the formula P (1 + r)t. “One Grain of Rice,” the folk tale by Demi, is centered around a reward where a single grain of rice is awarded on the first day and the number of grains of rice awarded each day is doubled over 30 days. At the end of the month, over 536 million grains of rice would be awarded on the last day. Western companies, particularly in Britain and the US, have traditionally paid the most generous dividends, says Tim Harvey, the director of Offshore Online, an international broker. “That is slowly changing. Japanese companies are starting to pay income. So are many in China and the Far East.”

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

The Federal Reserve’s ongoing battle to tame inflation has kept interest rates high. You can use a high-interest savings account to leverage the power of compound interest. To find the compound interest, we should know the principal (P), rate of interest (r%), time period (t), and the number of times the amount gets compounded in a year (n). If the amount is compounded daily then it gets compounded 365 a year. It will generate more money compared to interest compounded monthly, which has only 12 compounding cycles per year. In all these formulas, P is the initial amount, ‘r’ is the rate of interest, and ‘t’ is the time period.

Did Albert Einstein declare compound interest to be ‘the most powerful force in the universe’?

For instance, the purchasing power of $787,180 today would be approximately $434,580 in 30 years, assuming a 2% average inflation rate. The Rule of 72 is an easy compound interest calculation to quickly determine how long it will take to double your money based on the interest rate. Simply divide 72 by the interest rate to determine the outcome. At a 2% interest rate, it would take 36 years to double your money.

Compounding typically refers to the increasing value of an asset due to the interest earned on both a principal and an accumulated interest. This phenomenon, which is a direct realization of the time value of money (TMV) concept, is also known as compound interest. The good news is that you can feel the power of https://www.business-accounting.net/ compound interest simply by paying money into a savings account and patiently letting it grow in value, year after year. Allan S. Roth is the founder of Wealth Logic, an hourly based financial planning and investment advisory firm that advises clients with portfolios ranging from $10,000 to over $50 million.

Best High-Yield Savings Accounts for June 2024

Had the investment only paid simple interest (5% on the original investment only), annual interest would have only been $5,000 ($500 per year for 10 years). First, the yield, which is calculated as the dividend payout divided by the market valuation of the company. If the dividend is $5 and the company is valued at $100, the yield is 5 per cent.

This powerful force allows someone to invest a sum of money today that will grow into a much larger amount. If you are patient, and stick with your investments over time, you will almost always come out ahead. Racking up a seven-figure retirement account might seem far-fetched, but the Roth IRA rules make it possible. A Roth IRA is a tax-advantaged retirement account that allows your investments to grow tax-free, and qualified https://www.accountingcoaching.online/activity-based-costing/ withdrawals in retirement are also tax-free. Einstein’s appearance in Oppenheimer is critical within one of the film’s biggest twists, and allows Nolan to end the film on a quiet and contemplative note. While it is initially suggested that Strauss has an affinity for Oppenheimer, it’s revealed later on through a conversation with a senate aide (Alden Ehrenreich) that their relationship was far more contentious.

If you invested US$10,000 (Dh36,731) at 3 per cent a year, but withdrew all the interest every year, you would have $16,000 after 20 years. But if you allowed the interest to compound, your savings would grow to more than $18,000. And when savings rates finally revive from today’s miserable lows, the effect will be even more powerful. Now if Dad had invested it in the stock market and averaged 10 percent annually, June would be pocketing some real money – $69,586 – and could do a whole lot better than a dinner. Maybe take the family on a nice first class vacation, for example. It seems Einstein would not be too happy with the way people revere the most popular financial gurus.

Compounded interest depends on the simple interest rate applied and the frequency at which the interest is compounded. These examples illustrate the importance of the interest rate and duration of your investments. With that being said, risk tolerance should always be considered with higher interest rates; a higher rate of return generally comes with additional risk.

So, with a 10% interest rate, your money would double in about 7 years. Simply divide 72 by the interest rate, and voila, you have the number of years it’ll take to double your money. The rule of 72 is a quick, easy way to calculate how long it will take for an investment to double based on the interest what is a financial statement detailed overview of main statements rate. He said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” The compound interest can be greater than the principal over a period of time. “For the seriously long-term investor, dividends are where the action is,” he says.